Vecteur Stock Capital gain, net income, monetary profit and growing graph up. Economic growth, income from investments. Metaphor of business success. Difference between purchase price of an asset and its sale price

Short term Capital Gain disposed off within a Short Span of time will not justify the gain to be treated as Business Income: ITAT

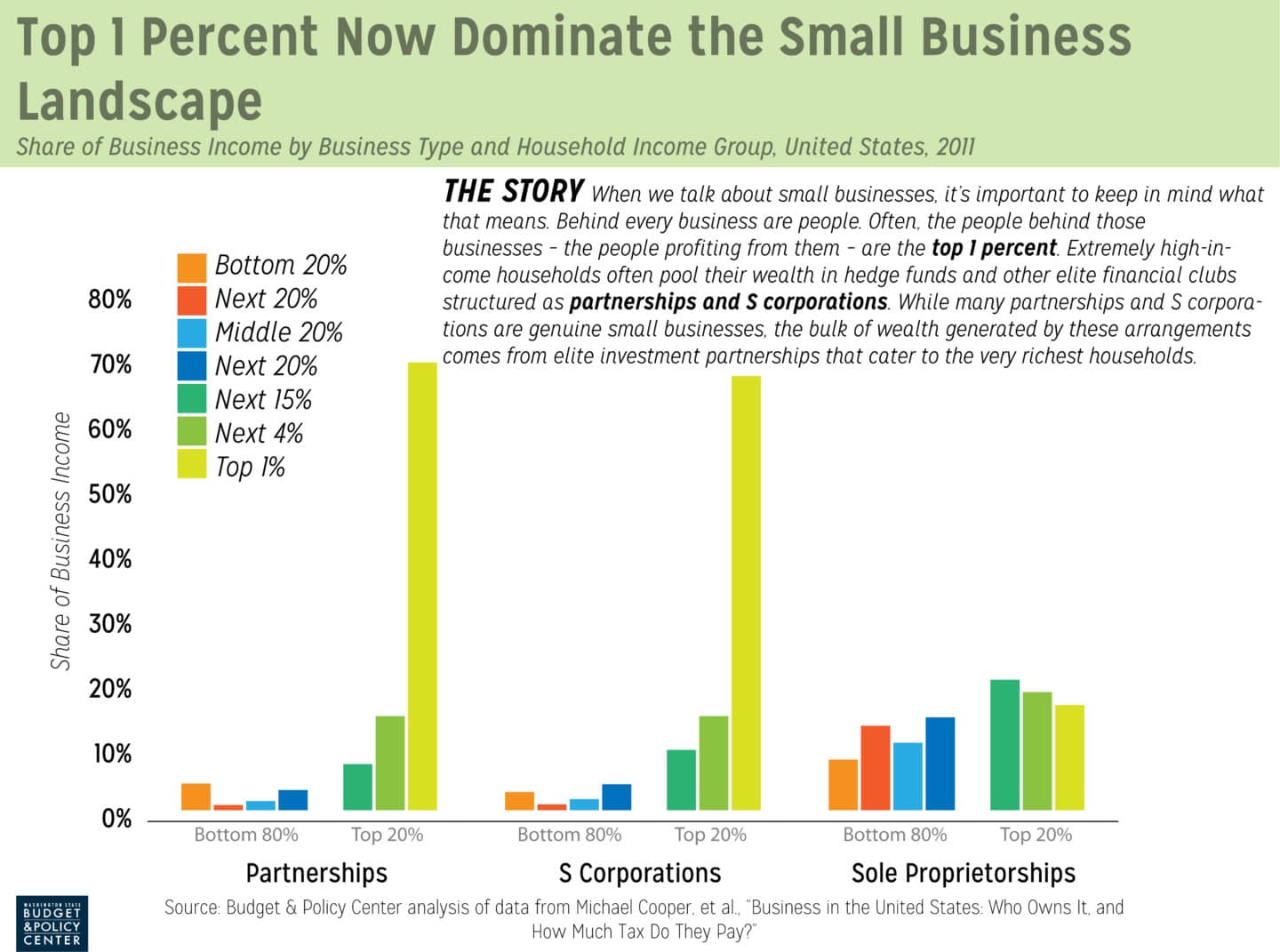

U.S. income inequality is worse and rising faster than policymakers probably realize - Equitable Growth

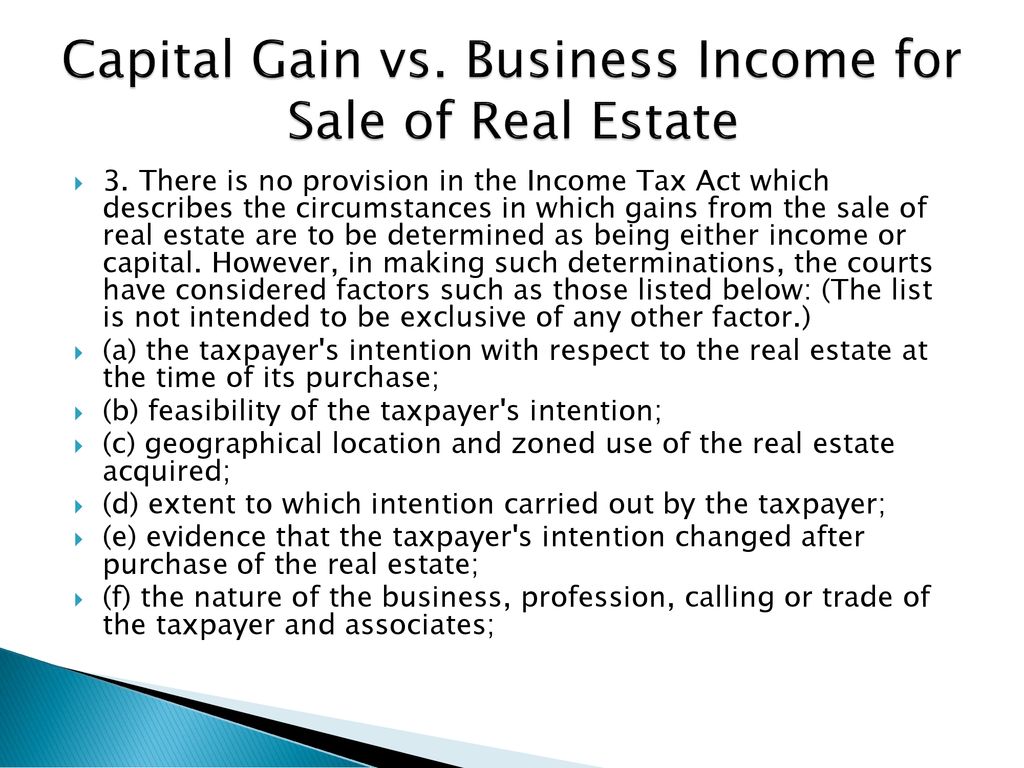

Capital Gains vs. Business Profits – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students